Assessing reits investment attractiveness over a multiyear period

My friend Jack, a dividend investor was having coffee with me when he popped a question. Is it still worthwhile to invest in reits (i.e real estate investment trusts) during the period of rising interest rates?

Hmm…I asked him can we qualify what are reits and where does it gets the money to pay its investors? Jack, who had invested in reits told me that reits get their income from rental of its properties. The reits manager will then give at least 90% of its income as dividends to its investors. Usually, these dividends are paid quarterly.

So what makes a reits investment attractive? I asked.

Of course, it’s the reits’ dividend yield. Jack answered. Many reits investors are invested for the dividends that they can receive. But with the rising interest rates, reits has fallen out of favour and their share price has fallen. He told me.

As such, is it still worthwhile to stay invested or even put more money into reits? He queried as he invested in reits for a long time.

Investment in reits and assessing its attractiveness over a long term period. Hmm…this sounds interesting. I am intrigued. I told Jack, I am keen to work on looking into this. However, there is a need to understand more on the investment domain knowledge.

Hence, for the next several weeks, I had met up with Jack as we read in-depth financial news, companies’ financial statements, dividends pay outs and the reits business operating environments.

As it is quite a big topic, we decided to focus on the qualifiable aspects. We will only look at dividends, its share price, dividend yield, risk free rate and of course the attractiveness of buying reits.

How to determine a reit is attractive to buy today? Jack asked. After we have gone through the several weeks of studying the data as we sat down together for coffee in our usual coffee haunt.

It is not just its dividend yield. I answered him. Many investors are only looked at the current dividend yield. Yet, it does not explain why the reit share price keep on falling and the yield seems to be getting higher. See below for the divident yield formula.

i.e Dividend yield = dividends/share price.

Jack asked. Isn’t this a straight forward equation. A bigger dividend over a lower share price gives you a better dividend yield? He asked. Therefore, investors should buy higher dividend yield reits’ stocks.

I agreed with Jack. It is precisely such a simple equation that had mystified many dividend investors. Many investors bought high yielding reits only to suffer losses. Yet, they still cannot understand why these investments did not work out as expected. I replied.

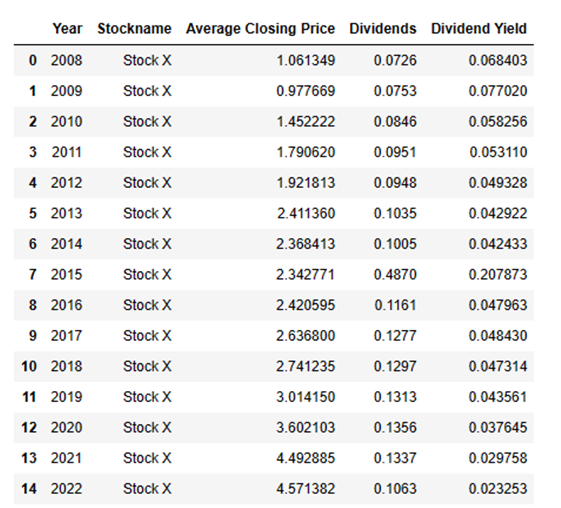

In order to understand, if a reit investment is attractive, I have downloaded a reit stock price, let us name the reit as stock X. The daily stock price from 2008 to 2022 is downloaded and is then its average price for the whole year is calculated. See below.

Jack saw the stock price table above and exclaimed. Wow… such an outstanding stock performance. This stock has only one losing year in 2009. After that, it has only gone up and up. He wonders what is the stock X name. If only he had bought this stock, he would be able to retire sooner.

How about the dividends. Jack cannot contain his excitement. Quick, let me know, I wanted to know, if the dividends are as good as the stock price. He asked earnestly.

Using python coding, I had used an api to extract the yearly dividend and tabulated next to the stock price. See below

Jack saw the dividends has been increasing every year. From 0.073 cents in 2008 to 0.1356 cents in 2020. This stock is really something. In fact in the year 2015 it even gives a bumper 0.487 cent dividend. He shared with me.

I smiled. Yes, this company does gives generous dividends over the years. In 2015, it gives the special 0.487 dividend due to its divestment of one of its cluster of properties. All these dividends helped to justify the rise of the share price.

Jack studied the dividends yield and remarked, hmm… so the dividend yield is around 0.05 from 2010–2013. The dividend yield was roughly aligned with the share price increase.

I concur. With the exception of special dividend in 2015, the company has continued to give more dividends and it further propel the increase in the share price i.e 2015–2021.

Well, even in 2022 its stock price seems to be holding up, despite US federal reserve multiple rate hikes. This brings to the point of risk free rate. A risk free rate, is the interest rate that investors will get its returns no matter what happens to the stock market. We will pegged this risk free rate to the US 10 year treasury bond. US 10 year treasury bond is the interest investors will get from the US government over a 10 year period. Nothing is safer than US government bonds. As such, we will pegged the risk free rate to this 10 year treasury bond. You can get the 10 year treasury data from this link. Treasury Yield 10 Years (^TNX) Charts, Data & News — Yahoo Finance

We will put in the 10 year treasury data along with the stock table. See below.

10 year treasury yield has fallen from 0.036 in 2008 to 0.0178 in 2012. It becomes obvious that holding US treasury bond is not attractive. Some Investors seeking better yield has turned their attention to reits/stocks. Calculating the difference between the stock dividend yield and the 10 year treasury yield, you can see that it is positive and has increased from 0.026 in 2010 to 0.031 2012. It means, reits yield perform better, when the US government treasury yield is falling.

A risk free rate increase means it becomes harder for reits to attract investors. The difference in the stock yield against the 10 year treasury shows this difference has narrowed in 2020–2021 and has even gone negative in 2022.

In other words, investors will sell out this stock X to buy into the US 10 year treasury bond, that not only gives better yield, but it is also safer.

Jack digested this information that I have shared. It is certainly a lot to take in. He remarked. Shrewd investors don’t just look at the current stock yield. There are other considerations, such as stock price, how much the past dividend, is the dividend paid out rising/falling or constant and is it consistent over the years. Not forgetting the US fed interest rate does impact the stock yield too.

Jack then asked. What is stock X?

I replied. This is not an investment advice. It is purely for education purposes. What I have presented is just from my own perspective. I hope to showcase a unique proposition on looking at stock price and dividend yield performance. It is another way of assessing a stock/reits performance other than looking at analysts’ reports. However, I can offer you my python coding on what I have shown here, which allows you to look at reits on these parameters that I have shown. You can analyse other reits or dividend paying stocks by just adjusting the stockname in the coding.

Jack took everything I had presented. Then he asked in 2023 what will happen to stock X?

The market will adjust itself to make Stock X attractive again. Until that happens, I advise him, don’t bother buying stock X. In fact, it will do him good not to know what is stock X too. I smiled.

Do share and like this article, if you enjoyed it. You can link me on my linkedin.com/in/chewlinkiat to get future updates on my sharing of insights in using python coding and data analysis.