Rental properties in Singapore. A detailed look at transactions and rent prices.

Condo as rental investment in Singapore. How did it perform from 2019(Feb) to 2024(Jan)?

There were many news about rising residential rents in Singapore over the years. In this article, we will explore which district has the most condo rental transactions and how have these rents jumped in 2020–2023. Also, I have included data in 2019(Feb-Dec) and 2024(Jan) for reference. As property investors or even real estate developers, it is important to know where to invest in order to get a good return on investment. As the saying goes, property is all about location, location and location.

Overall rental transactions and rental prices across all districts

Let us look at the districts and median property rents in Singapore from 2019(Feb) to 2022 (Full year). The data is retrieved from urban redevelopment authority (i.e URA) website.

Table 1 is sorted by rental transactions from 2019–2022. I have also aligned the median rent with these transactions. If you are an investor in the year 2022, which district would you have bought the property to generate a better return on investment (i.e ROI)?

In 2021, the number of rental transactions reaches a peak. Covid has resulted in many people seeking to rent condo as an alternative to work from home. We have seen a spike in transactions to 92,641 transactions in 2021 vs 86,565 in 2020. Correspondingly, the rent also went up from $3052 to $3163 i.e 3.6% increase. In 2022 vs 2021, the transactions fell to 84,728 i.e 8.5% decrease and rental prices went up by a significant 19.1%. This is a classic case of decrease in supply, resulting a significant increase in rental price due to higher demand.

In table 2, I have tabulated the data from 2022 to 2024(Jan). Using the 2022–2023 data to compare the year on year growth, we can see the number of transactions has fallen by 8.7%. On the other hand, the median price has gone up by $3,767 to $4,561 i.e 21.1%. The supply and demand factors are at play resulting more demand pushing up rental prices. Landlords in the year 2023 have received generous rental revisions on their rental leases which helps to alleviate the mortgage loans increases from the increase in interest rate.

A deep dive analysis into district 15 for 2 bedroom condos

District 15 is one of the top 5 transacted rental properties in Singapore. It would be interesting to check, if the supply of new condos would have an impact on existing condos transactions and their rents. By sorting the top 8 transactions in district 15, we can see the below table.

District 15 had a new TOP condo Seaside Residences in 2021. As a new condo, it will generally attract a lot of new tenants eager to stay in the condo, especially those who are already staying nearby. We can see that in 2021–2023, the Seaside Residence condo attracted 47 in 2021 to 82 in 2023 new rental transactions. Correspondingly, those transactions that exclude Seaside Residences fell from 508 in 2021 to 368 in 2023. This shows there are tenants who have moved from nearby condo to the new condo. At the same time, we observed that the median rent has gone up. It means the supply of new condo for rental was well absorbed by the market and demand was still pushing up rental prices.

However, at the start of 2024, we began to see softer rental prices. Rental prices fell across 7 of the 8 projects listed in table 1. It is worth noting that the transactions in Jan 24 is still small and it can lead to large variations in median prices, as we move into more months in 2024.

In Singapore, tenants typically signed a 2 year lease. We can observe that those renting in 2022, would be the tenants looking to renew their leases in 2024. Checking the median prices in 2022, the gaps on prices rented in 2022 vs 2024 is closer than those in 2023. This means, as long as the landlords’ demand on rental pricing is not too far from 2022, tenants may choose to accept the rental revisions and continue with their leases.

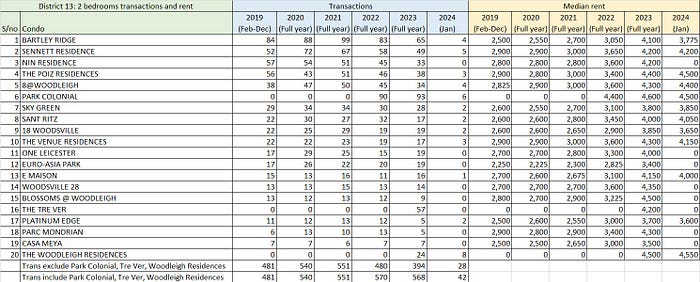

A deep dive analysis into district 13 on 2 bedrooms condos

The difference in district 13 vs district 15 is, there are a lot of new condos TOP in district 13 in 2022–2023. These are Tre Ver, Park Colonial and Woodleigh Residences. It will be interesting, if we can see the demand can match with the supply coming onto the market and rental prices can continue go up. Using the top 20 condos by transactions in district 13, we can show the data below.

No of transactions excluding the new condos Park Colonial, Tre Ver and Woodleigh Residences were 540 in 2020 and it fell to 394 in 2023. On the other hand, including the 3 new condos, transactions would have increased from 481 to 568 in 2020 to 2023. This shows that the new condos are taking away demand from existing condos. Median rental prices continues to go up from 2019 to 2023 across all the top 20 condos. On surface, we can observe that the new and old condos benefited from increased in condo rental prices, even though supply has increased in this district.

A potential rental price revision is coming (if it is not already here!)

However, if we take a closer look, it is showing significant impact especially on older condos. For example, let us view at the transactions for Bartley Ridge. This condo TOP in 2016, it is still relatively new compared to the other older condos. In 2021, it recorded 99 transactions. In 2022, it registered 83 transactions and 2023 it has only 65 transactions. It showed a drop of 34% transactions from 2021 vs 2023. In Jan 2024, it only has 4 transactions. This means, the rental demand for this condo has continued to decline over the years. In fact, the median rents have fell from $4,100 to $3,775 in 2023 vs 2024. If there were 99 tenants rented the Bartley Ridge condo in 2021, where are these tenants in 2023/2024?

It is likely these tenants have opted to rent the new condos since the rental prices on the new condos is just a few hundred dollars more than Bartley Ridge. The Bartley Ridge rental prices fell in 2024, landlords would have to lower their rents in order to attract some tenants back. But the key question is, is it enough?

In fact, Bartley Ridge is not the only condo. This can be seen from the Sennett Residences, Nin Residences, Poiz Residences and 8 @ Woodleigh as well. All these top transactions condos in district 13 showed significant fall in demand after the arrival of the 3 newly TOP condos. Take for instance, Nin residences has 51 transactions in 2021, but in 2024 (Jan) it has none. There are still ads on Nin residences rental in 2024, however, it is unlikely to get tenants, if it is priced at 2023 rental prices.

Rental market to go softer in 2024

It is the landlords’ market in 2023. In 2024, with more supply and overpriced rental market, we are likely to see lower rental prices in the coming months. This will impact property investors who have invested in condos. The silver lining on this, is the mortgage interest rate is forecasted to go down, because the US Fed has indicated it will lower the interest rate this year. It is widely believed that singapore mortgage rates has a high correlation with US Fed interest rate movement. As such, with lower mortgage interest rate, property investors can afford to price their rental prices lower to attract tenants.

For those interested to know more about this (I have consolidated all districts by projects on transactions and rental prices from 2019(Feb) to 2024(Jan)) or to discuss on property rental in Singapore, feel free to contact me on my linkedin linkedin.com/in/chewlinkiat